Investing through unregulated LLPs

Why is the practice prevalent and what are the risks?

TL;DR:

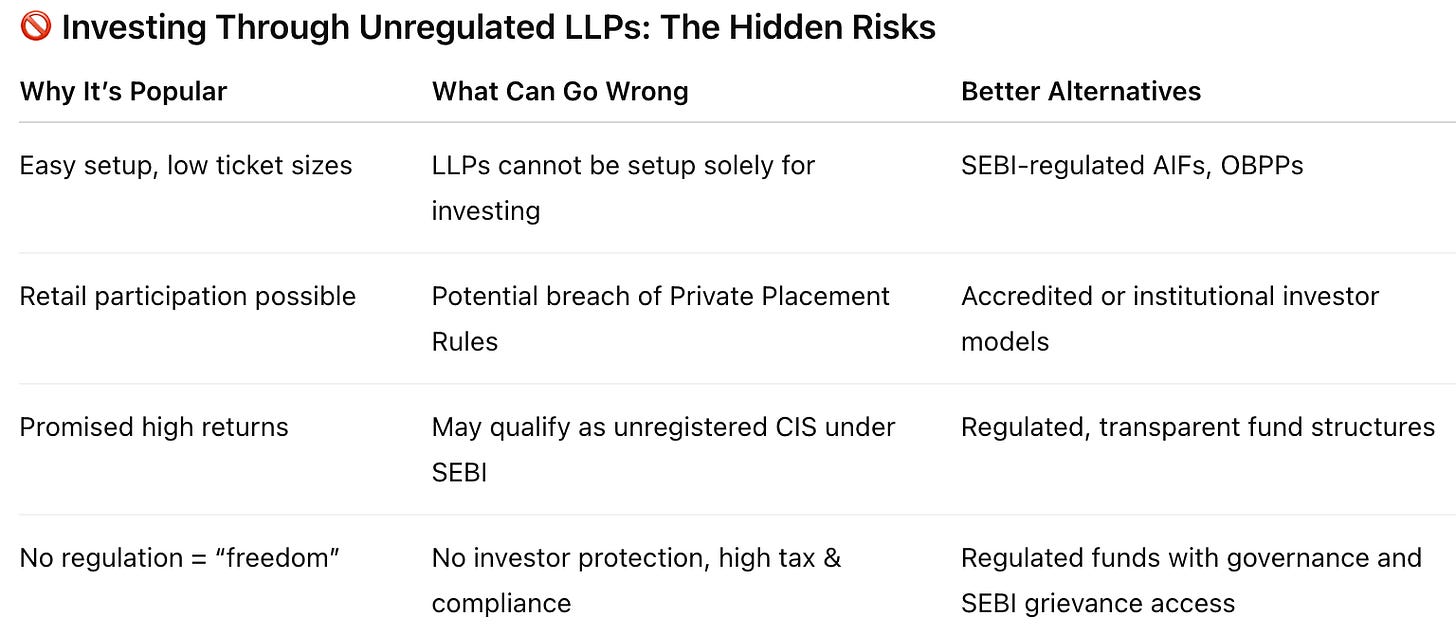

Investing through LLPs has become popular among investors seeking startup exposure, but the model is largely unregulated and high-risk. LLPs cannot be setup solely for the purpose of engaging in investment activities, yet many are, under the guise of providing “advisory services,” exposing partners to potential regulatory violations. Such setups often breach private placement limits, risk classification as unregistered Collective Investment Schemes, and offer limited investor protection or redressal. They also face higher taxes and compliance burdens than regulated structures. Despite the promise of accessibility, LLP-based pooling is marred with regulatory complexities and hidden costs. AIFs and SEBI-regulated platforms remain the safer, compliant routes for private investing.

Sudhir, an erstwhile CXO at a logistics company, came across a post by a startup evangelist promising 6x returns on a (risky) startup investment. With limited exposure to the ecosystem, but driven by a fear of missing out, he decided to invest. When he learned that the minimum contribution is INR 40 lakhs, he told his former colleagues about this lucrative opportunity. In no time, he convinced four of them to co-invest. They set up an LLP with five partners, each contributing INR 8 lakhs, and completed the investment. In six months, the company had gone on to raise another financing round, doubling its valuation. Word got out and Sudhir was now flooded with inquiries from folks looking to hop on the bus. By year two, the LLP had more than fifty investor-partners and had invested in four more startups.

Mark, a restaurateur, opened a cafe in South Mumbai serving specialty coffee. In the last few years, homegrown coffee chains had benefited from a surge in youth coffee consumption and increasing investor interest. On the back of the success of the first store, Mark decided to approach investors to complete his first fundraise. Several disagreements on valuation later, Mark found himself evaluating an investment offer that involved two partners setting up an LLP, and raising the target amount through several investor-partners contributing anywhere between INR 10,000 to INR 10,00,000 at Mark’s desired valuation.

An investor roadshow in a tier-III city proved to be a great success. When you look at what was on offer, it is clear to see why - minimum cheque size of INR 5,000, tax-free assured returns of at least 15%, and a capital end-use for advancing farming in the country. Eventually, 5000+ investor-partners contributed more than INR 180 crores through one of the three LLPs set up for pooling investor-partner funds.

On the face of it, the schemes may appear very different and not set alarm bells ringing. But there’s a lot that is common - the participation of retail investors en masse, low ticket sizes, unregulated investment structures supported by LLP formation, and an eventual unravelling of such schemes that leave investors stranded, often with no regulatory recourse at all. Admittedly, investors should exercise their due diligence before deciding to invest. But pointing fingers only at the investors is very short-sighted. Often, what allows these unregulated structures to grow, operate, and go under the radar is a myriad of regulations that are unknown, or complex and unclear.

Regulatory Risk

Investment Activities

LLPs cannot be formed solely or mainly for the purpose of engaging in ‘investment activities’. Investment activities fall under non-banking financial activities, which are regulated by the RBI. The RBI permits only companies (registered under the Companies Act, 2013) to conduct non-banking financial activities. LLPs are not eligible for such registration and, consequently, are restricted from carrying out investment business as their principal activity.

LLPs, to circumvent this restriction, will often call out an ancillary business activity (for example, providing investment advisory services) as their principal business in the LLP constitution documents. This may not pose a challenge in the initial days of LLP formation, but as the LLP continues to onboard investor-partners and make and exit investments, it will be increasingly under risk of scrutiny. Such scrutiny may even result in penalties being levied on the LLP, and in certain situations, even on the investor-partners in their individual capacity.

A related consideration is that the income from the provision of such services is taxable at 30%. While the profits distributed (from such income) to partners are exempt from tax, the tax rate on LLP’s income can rise to 40%+ with the inclusion of surcharge and cess. Regulated AIFs, on the other hand, are pass-through entities; in the event of a distribution event, the AIF does not bear any tax burden. The investors are liable to pay tax on the investment proceeds received by them. As of 2025, based on the holding period, the rate of taxation is either 20% (Short Term Capital Gains) or 12.5% (Long Term Capital Gains).

Private Placement

Due to the low-ticket sizes, and the inherent nature of investment schemes that utilize LLP structures, newer investor-partners need to be solicited and onboarded to raise funds.

Companies that accept such an investment may, without even being complicit in the solicitation activities, violate the private placement rules specified in the Companies Act. Private placement guidelines restrict making an offer, or even advertisement of an offer for securities to more than 199 individuals. In addition, the company cannot release public advertisements or utilise media, marketing, or distribution channels to attract investor interest. The company is even restricted from using distribution agents to inform the public of a private issue of securities.

Unregulated schemes often leverage investor roadshows, digital ads, webinars, etc, which are, in most cases, conducted and published to audiences much larger than the permissible limit of 199. Such schemes are at risk of levy of hefty financial penalties, and being ordered to return funds with above-market interest rates.

On top of that, the advertisements, bereft of regulatory oversight, need not follow a code. The result is that investors are often misled or swayed by celebrities, technical jargon, deceptive statements, and exaggerated returns. Compare this with Online Bond Platform Providers (OBPPs) that come under SEBI’s purview and are mandated to follow a comprehensive advertisement code developed to enhance investor protection!

Collective Investment Schemes (CIS)

Consider the three instances of LLP formation and utilisation that we discussed above. They share certain features that make them susceptible to being deemed as ‘collective investment schemes’ - (i) pooling of money for an investment scheme, (ii) pooling for purpose of receiving profits, income, revenue-share, etc., (iii) pooled funds managed on behalf of investor-partners, and (iv) investor-partners having little to no control over the day-to-day management of the scheme. When a scheme with these features crosses an AUM-threshold of INR 100 cr, it is mandatorily required to be registered under the SEBI (Collective Investment Schemes) Regulations, 1999. A failure to do so can result in suo moto regulator intervention, financial penalties and freezing of funds.

Investor Protection

Regulatory Adherence & Redressal Mechanisms

Platforms regulated by SEBI, or RBI, ensure that entities that engage in or facilitate investment activities operate within the contours and restrictions specified in the relevant regulations. For instance, only accredited or ‘angel investors’ can invest in AIFs regulated by SEBI, and even then, the investment thresholds are high enough to curtain retail participation.

These regulations, apart from specifying qualifying criteria and mandating disclosure norms, also provide investors recourse to redressal mechanisms to alleviate their concerns. Take the example of SCORES, SEBI’s Complaints Redressal System, which saw a resolution of 4,239 investor complaints just in the month of April 2024.

Decision-Making & Other Legal Rights

Even though investors are designated as partners in the LLP, they seldom inherit or retain the ability to make decisions that impact their investments. This can be done explicitly, through execution of power of attorneys, or implicitly, when unassuming investors are onboarded to the LLP through seemingly boilerplate agreements. Worryingly, the partners that inherit the decision-making powers are not under any fiduciary duty to take actions that are without prejudice to other partners.

In contrast, regulated schemes, such as the ones under the aegis of the AIF regulations, require the AIF (and the manager, trustee, and sponsor) to follow a Code of Conduct that ensures paramount investor protection, and a strict adherence to the intent and structure of the scheme.

Compliance Burden

The regulations governing registered AIFs, OBPPs, CISs, Real Estate Investment Trusts, and NBFC - P2P Lending Platforms place the burden of compliance on the registered entities, as against individual investors. However, LLPs require the investor-partners to ensure that proper books of accounts are maintained, and (tax and financial) returns are submitted in a timely manner. The annual returns require each investor-partner to disclose names of other companies and LLPs where they hold a similar position. When new investor-partners are onboarded, or there is a change in either the LLP agreement or contribution of any of the partners, the requisite forms need to be filed with the MCA.

Conclusion

Investing through LLPs may seem like a lucrative proposition - the relative ease of setup, ability to onboard newer investor partners, and no minimum thresholds. But if we weigh the risks , it is clear why this route is not sustainable or cost-efficient in the long term. The motive of democratisation of private markets and increasing retail participation is indeed a noble one. But not if regulations are flouted, exposing investors to high risks, which they are often unaware of. The regulations are enacted only after discussions with, and inviting input from, industry experts and even the public at large. So while the regulatory thresholds, entry barriers, and code might seem onerous at first, they are formulated for good reason - to safeguard investors.